Content

- Double-Declining Balance Depreciation Method

- When to Use SYD Method?

- What Is the Residual Value of Fixed Assets and How to Calculate It

- Sum of years calculation

- Easy Methods of Calculating Sum of Years Digits Depreciation with Formula in Excel

- Sign Up for our Free Excel Modeling Crash Course

Life — useful life of the asset (i.e., how long the asset is estimated to be used in operations). Total depreciation for four years ($16,000 + $12,000 + $8,000 + $4,000) will be $40000. So, the value of the asset at the end of its useful life become zero. Per is the year for which the depreciation needs to be calculated, such as the first year, the second year, etc.

- A living trust can help you avoid the lengthy and expensive probate process and give you control over your assets during your lifetime.

- Depreciation values, returned as a 1-by-Lifevector of depreciation values with each element corresponding to a year of the asset’s life.

- However, the company needs to properly allocate the cost so that the depreciation expense charged to the income statement matches the benefits that the company receives from the fixed assets.

- The unit used for the period must be the same as the unit used for the life; e.g., years, months, etc.

- Mega Coffee believes that at the end of the computers’ 5-year useful life, they will be worth $200,000.

- The Company considers that the useful life of Computers is five years and they can expire the computers at a value of 100,000.

The depreciation expense that declines is frequently countered by an increase in maintenance expense, smoothing out the revenue over time. The total cost of an asset is $2,000, the residual value is $500, and the estimated lifespan is five years.

Double-Declining Balance Depreciation Method

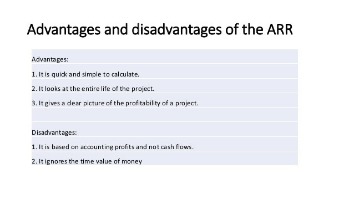

Similar to declining balance depreciation, sum of the years’ digits depreciation also results in faster depreciation when the asset is new. It is generally more useful than straight-line depreciation for certain assets that have greater ability to produce in the earlier years, but tend to slow down as they age. This method provides the company with a tax shield, especially when the asset is new.

Carriage Services Announces Fourth Quarter and Full Year 2022 … – GlobeNewswire

Carriage Services Announces Fourth Quarter and Full Year 2022 ….

Posted: Wed, 22 Feb 2023 21:36:28 GMT [source]

When you https://intuit-payroll.org/ an asset, you recognize an expense that represents the value of the asset used during the period. Suppose we want to calculate the depreciation for an asset with an initial cost of $300,000 and a salvage value of $5,000 after 10 years.

When to Use SYD Method?

Since the depreciation charge is higher in the initial years, it reduces the net income and also the tax liability. In excel also, there is a function to calculate depreciation based on the SYD method.

Now, let us see both of the formulas based on these arguments. It is the total interest charge in the lease agreement and distributes it over the life of the agreement in proportion to the balance outstanding. There are different methods of depreciation, such as Straight Line Depreciation , which has been discussed, Double Declining Balancing Method , Sum of Years Digit Method , or Unit of Production Method . So as of calculation, we have a total cost of $4,200,000; a residual value of $1,000,000.

What Is the Residual Value of Fixed Assets and How to Calculate It

The sum of years’ digits method is a form of accelerated depreciation charge that is based on the assumption that the productivity of the asset decreases with the passage of time. Under this method, a fraction is computed by dividing the remaining useful life of the asset on a particular date by the sum of the year’s digits. This fraction is applied to the depreciable cost of the asset to compute the depreciation expense for the period. Sum of the years’ digits depreciation is the type of depreciation method that allocates the higher cost of the fixed assets in the early year and reduces the depreciation expense in later years as time passes. The company can calculate sum of the years’ digits depreciation after determining the expected useful life of the fixed asset and the depreciable cost to use as a basis of calculation.

Companies facing difficult tax environments may also prefer the SYD method to realize bigger tax savings in the early years of the assets. It helps to align the cost of using an asset with its use each year over the life of the asset. This means the method is practical as an asset is usually more productive in its early years. A manufacturing company Delta Inc. has purchased machinery for USD 4 million. The useful life of the machinery is seven years, and its residual value is 300,000 USD. The company has incurred the transportation-in expense of USD 100,000. Let’s comprehend the process of calculating depreciation with the help of an example.

Sum of years calculation

To Calculate Sum Of Year Digits Depreciation s the exact depreciation amount for the current period, based on the annual expense and the change value. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas.

Multiply the depreciable amount with the depreciation factor. Instead, a similar phenomenon known as amortization has been put into place for catering the intangible assets. Therefore, the intangible assets are amortized and not depreciated. The tangible assets are the physical assets that can be touched and seen. Plant, machinery, furniture, office equipment, factory, buildings, etc., are common examples of the tangible assets owned by any business entity. The asset has 3 years useful life at the end of which it is not expected to have any salvage value. Write a short paragraph to explain the concept of depreciation as used in accounting.

Also, there is a high probability that the computers will become obsolete before their useful life is up. Create a depreciation schedule to model how these assets can be depreciated. The assumption that assets are more productive in the early years than in later years is the main motivation for using this method. The double-declining balance depreciation method is an accelerated method that multiplies an asset’s value by a depreciation rate. Use this calculator to calculate an accelerated depreciation using the sum of years digits method.

- It also considers that depreciation charges are higher in the early years of an asset’s life and lower in the later years.

- It keeps decreasing as the asset life increases, and it becomes obsolete.

- For more information, refer to Calculations and Averaging Conventions.

- Since the economic benefit from fixed assets is extended for several financial years, they are not debited to the expense account at once.

Compute the depreciation expense using the Straight-line method for 2014. To find the delivery truck’s remaining useful life, we need to count it from the start of each year rather than the end.